Comment

Trending badly

How should we think about County budgets? Should we bother with them at all? Will it make a difference? If so, how do we wade through 67 pages of an operations budget and a 276-page capital budget? Without a finance background or accounting training? Or amphetamines?

As a letter writer observed last week, Shire Hall struggles to communicate effectively. While it does many things well, explaining the complex forces buffeting its decision-making and informing ambitions is not among them.

So we are left alone to break down the municipal budget, decipher its implications, and discern trends. To do this, we must reduce it to the essential bits. The most essential of these bits is the tax levy. It is the clearest indicator of the performance of municipal government. Simply put, the tax levy is the amount left over once the revenue Shire Hall expects to receive is deducted from the expenses it plans to spend in the coming year. Expenses minus revenue equals the tax levy.

An array of other calculations determines how much of that levy you will pay in property tax. But keep your eye on the levy. It is the clearest barometer of how Shire Hall manages County business: where it’s been and where it is going. And how much longer can we afford to live here?

The proposed tax levy in 2023 is 7.2 per cent—that is, it will cost 7.2 per cent more to keep the local government machine running in 2023 than it did last year.

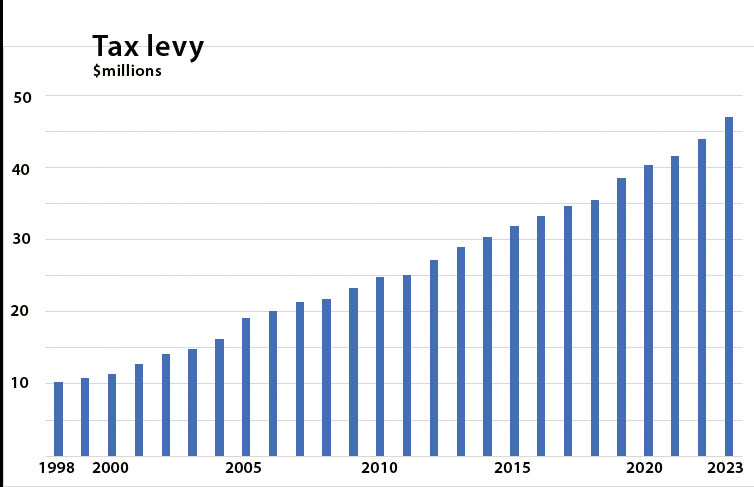

The trend, however, is more important than the snapshot. To understand where we are going, you must know where we’ve been.

When the County was amalgamated in 1998, the tax levy in that first budget was $10.3 million. The tax levy currently on the table aims to top $47.0 million in 2023. About 25,000 folks lived here in 1998. About 25,000 folks live here now. The cost to keep Shire Hall flush demands a nearly five times greater tax levy than it did in 1998. To serve the same number of folks.

The question becomes: Are County services 4.7 times better in 2023 than in 1998? Are we getting good value for the vast sums we are paying? Are roads better? Do we enjoy bigger and better parks? Libraries? Meeting places? Are we 4.7 times safer than we were? And if not, why not?

The thing about trends is that they keep on trending. Their trajectory doesn’t change until outside forces bend the line. Trends tell you as much about the future as the past.

At the current rate, the tax levy will double in 12 years. It will fly past $100 million in 13 years. The current rate has been sustained over 25 years; there is no reason to believe it will recede. The machine will get hungrier.

The County also extracts fees for various services, including garbage collection, building permits, and water services (though this should be a standalone utility—as users pay all the costs. Water bills fund this system—not property taxpayers).

User fees are rising even faster than the tax levy. From $3.7 million at amalgamation, Shire Hall collected $18.4 million in user fees in 2021—a nearly five-fold increase since 1998.

These trends are shouting at us: Why? What is driving these increases? Are we getting better services? More? Different?

It bears repeating that the County’s population has barely budged in 25 years, so we know that residents aren’t driving costs higher. What about inflation? The Consumer Price Index (CPI) was up 6.8 per cent in 2022. Many things certainly cost more now than they did last year. Does inflation explain Shire Hall’s soaring costs? The answer is no—not even close.

Inflation has averaged just a tidge more than two per cent per year since 1998. It turns out 2022 was an outlier in a 25-year trend. Meanwhile, the County’s tax levy averaged a 6.2 per cent increase over the same period—three times the inflation rate.

New councils are fond of blaming their former colleagues for failing to feed Shire Hall sufficiently—that the challenges before the County today stem from underfunding by past terms of council. It is nonsense. The tax levy and user fees have been rising steadily and steeply every year since 1998. Faster than inflation. Faster than flat population growth would demand.

It turns out that throwing money at Shire Hall year after year, wasn’t the panacea some still wish it to be.

The trend is corrosive. It eats into the savings of many County residents who live on fixed incomes. It squeezes folks on the margins ever tighter. Each year it demands more—until we are making choices about food, heat and clothing.

Have you ever wondered why the population of the County hasn’t grown over 25 years? Lots of folks move here? How is it that the population has remained largely unchanged?

It’s the trend that’ll kill you.

What would be helpful here is deeper analysis. The province continues to download costs to municipalities, increased regulations, and I suspect changes in provincal governments have led to some broken agreements / deals. Understanding to what degree this has driven our increased tax burden might the real story?