County News

Fun house mirror

When financial reporting strays into marketing

When financial reporting strays into marketing

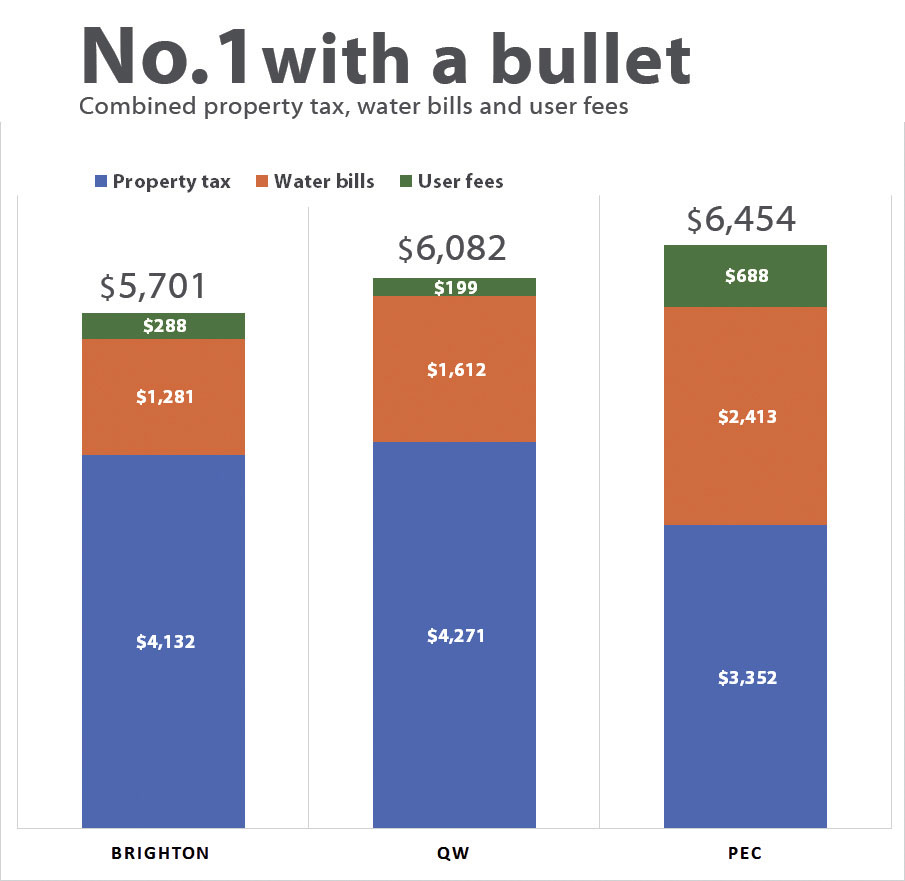

There is a chart in Shire Hall’s proposed budget book that asks you to believe something that just isn’t true. Just as a funhouse mirror presents a reflection of me as a thin waif of a thing, the budget book chart (page 18) offers a twisted view of reality. It wants you to believe that local government costs more in Brighton and Quinte West than in Prince Edward County.

To accomplish this feat, it only tells you part of the story. The bar chart, on its face, shows that property taxes are lower in the County than in the select neighbouring comparators. The message is clear. “Don’t worry that your taxes are projected to surge by 11 per cent.”

For sure, property taxes make a large portion of your payment to Shire Hall each year. But it’s not all you pay Shire Hall. If you get your water from the municipal utility, you already know you pay more than your neighbours in Brighton and Quinte West. Furthermore, you also pay a basket of user fees for garbage pickup, hall fees, and fees to use the ice at the rink for hockey or figure skating, etc.

When you tally up the revenue from all three sources, the picture is very different than the one in the County’s budget book. A more complete presentation reveals that Prince Edward County is back on top, with the average household spending nearly $6,500 each year to fund Shire Hall. Your tally compares to $6,082 in Quinte West and $5,701 in Brighton—the true winner in the cost-of-local-government sweepstakes.

So when someone tells you that you’re not paying enough taxes compared with neighbouring jurisdictions, ask them how they are cherry-picking their data.

A couple of other points on this chart. Both Brighton and Quinte West are largely urban municipalities. The County’s geography and thinly scattered population make it a poor comparator to Brighton and Quinte West. Urban neighbourhoods tend to consume/demand more and different municipal services than do the folks on Palmer-Burris Road or Maypul Layn.

It is why this newspaper continues to proffer Brant County as the County’s closest municipal cousin. Like Prince Edward County, it is a single-tier municipality, comprising a mostly rural population and a municipal waterworks spanning a handful of different and geographically dispersed systems.

When Brant is used as a comparable, Prince Edward County emerges atop once more—just eking past Brant as measured by the residential tax bill for a single-family home with an assessed value of $267,000. (See chart) A Brant County resident paid $3,202 in 2025 while a County homeowner paid $3,352.

NOTES

Some notes on how the Times comparables chart was composed. The property tax comparison uses the same assumption as Shire Hall’s budget book: a single-family home with an assessed value of $267,000. Deriving common water bills is a bit more complicated. Prince Edward County applies different rates for winter than the rest of the year. But when those rates are averaged out and applied to water usage profile of 200 cubic metres per year, it reveals that each household spends about $2,413 annually for water and wastewater services—far higher than both Brighton and Quinte West.

User fees also account for a big chunk of municipal revenue. Gleaning this as a common source across the three comparables is trickier still since all three municipalities lump all user fees together. For our purposes, we netted out Environmental Services user fees, since a large part of this amount is captured in waterworks rates. Taking the net user fees and dividing them per household yields a rough (and likely understated) number presented in this chart.

User fees require a definition. For example, pursuant to the County bylaw, user fees include amounts charged for a number of goods or services that are specific to an individual user only. Ice rental does not apply to my household as I have never and will likely never rent ice time. Even something as mundane as parking fees don’t apply to me, because I choose to park in areas that don’t have fees, but even if I did, the amount that I pay is specific to me. We could go on with this list including fees for building permits, fire department inspections, fire department fees to extinguish battery fires and more. User fees may generate significant revenue, but they do not impact my annual costs unless I engage those services. A few years ago, I paid a fee to obtain a minor variance. That cost did not impact my neighbours or you for that matter. As a result it is disingenuous to apply those fees to every household. What you have demonstrated however is that people living in the 3 communities you have chosen to compare actually spend virtually the same amount in their combined tax and water rates.