County News

Beyond the spin

Budget commentary

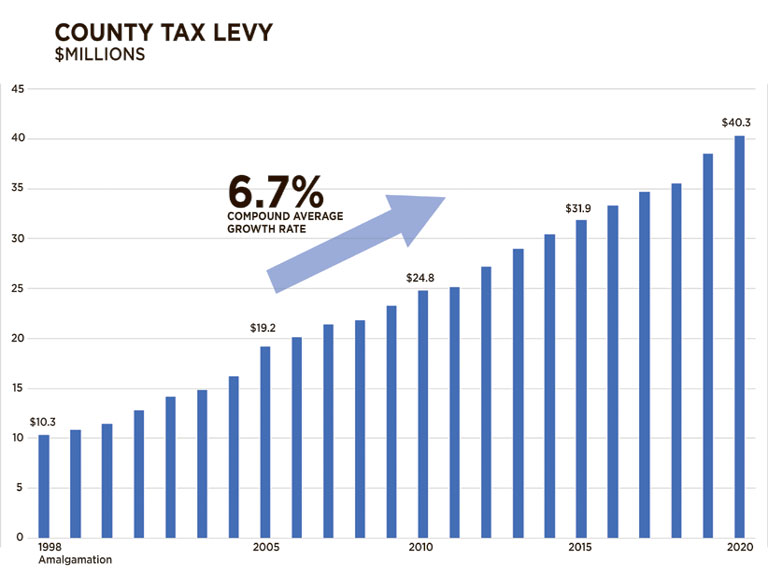

The County budget is set for 2020. The tax levy—that is the amount you and I pay directly to fund local government— is up 4.6 per cent to $40.3 million compared with $38.5 million extracted last year.

The increase this year is entirely the work of council. Staff, under the guidance of new CAO Marcia Wallace, said they could work with the same levy as last year, while they worked to prepare a plan to put the business of County government on a sustainable path. This will require time and, as Wallace noted several times during budget deliberations last week, involve lots of consultation with residents and stakeholders.

First, council agreed to take an extra $372,001 from taxpayers to put into a reserve for the new hospital. This addition resulted in a 0.6 per cent increase to the tax levy.

The more controversial hike in the levy came late Friday, at the end of the three-day budget deliberation. Council elected to extract four per cent more—an extra $1.5 million from taxpayers—for the County’s roads reserves.

In what has become now a perennial exercise in “getting serious” about County roads, council has failed to comprehend two important facts: First, taking an extra few million dollars or so from taxpayers each year, and throwing it into a deep dark hole, isn’t actually “getting serious”. And, secondly, most council members fail to see that the special levy they extracted last year, and the year before that, etc, is immediately swallowed into the baseline levy next year. So this year’s “special” levy isn’t $1.5 million at all, it’s $1.5 million plus last year’s special levy of $930,000, plus every other special levy council has ever approved. It’s not so special after all. It’s just a tax increase.

In fairness, CAO Wallace had advised council that the money raised by this year’s special roads levy would be put into reserves rather than actual roads, and that it would stay there until a road plan had been developed and properly aired in the community. It is not at all clear, however, that all council members grasped the significance of this distinction.

MARKETING AND OTHER FUMBLES

After council had been graced with a thoroughly transformational and professional budget process over three days—one that ushered clear, fresh air throughout Shire Hall finances—the debate veered off the rails within sight of the finish line.

Councillors suddenly dropped any pretense to governance and instead began to haggle over how much more taxes they could “sell” to their constituents. Hard scrutiny of expenses and projects gave way to marketing: How could they spin an increase to the tax levy into something taxpayers would buy?

SPIN 1. GROWTH MISDIRECTION

Here is how this works: Each year council hammers out a budget—how much it needs to run the business for the year. Then it deducts the amount it expects in revenue—user fees, senior government grants and such. The remainder is raised by property taxes. This is the tax levy. It is the closest thing there is, in municipal budgeting, to a bottom line. But, in most years, the municipality will generate extra taxes on every new home that is built and expanded. This is called new assessment or growth.

So, when councils seek to justify an increase to the tax levy, they are keen to show you what that increase would look like if they collect new assessment during the year. They don’t know what that will be, so they use the new assessment collected last year as a proxy.

This doesn’t happen just in the County. Plenty of municipalities do it. It isn’t illegal. But it is deceptive. And it confounds long-term trend analysis. Furthermore, it runs counter to the purpose of the budget exercise. Municipal budgeting is about coming to an agreement about what is needed to run the business for the year. When council obscures this serious responsibility by shoe-horning in items such as potential new assessment it weakens the exercise, it pads the budget. How this money is to be spent was never discussed or debated. It is slush and has no part in a serious budget exercise.

SPIN 2: HAVE I GOT A DEAL FOR YOU

But the marketing spin got worse. When an advertiser makes claims that for the low, low cost of $X you, too, can own their widget, and when they go on to say that the purchase price is equivalent to the cost of a cup of coffee a day—we know instinctively to be wary.

We know this is spin. Now it one thing for a huckster peddling kitchen gadgets or weightloss schemes to deploy such techniques; it is dispiriting to see our local government use the same methods.

The first line of the press statement released on Friday, announcing the completion of the 2020 budget described a tax increase of $15.30 per $100,000. Only in paragraph four does it mention that the tax levy is $40.3 million. But nowhere at all does the statement explain the tax levy was $38.5 million last year, or that this represents a 4.6 per cent increase year over year. (Or a combined 17 per cent increase, over two years, on the $34.4 million raised in 2018.)

The “per $100,000 of assessment” or its variants are crafted in order to persuade the reader that the amount is small. Or as one councillor noted “less than the cost of going out to dinner.” Like all illusions, it succeeds by misdirection. In this case, taxpayers are guided to notice only the impact of a tax increase compared to last year’s levy. It relies on the reader’s myopia and short attention span.

The truth is that tax levy has quadrupled in the two decades since amalgamation. A more honest comparison is that the average property tax bill was $903 per household in 1998 and has skyrocketed to $3,124 this year. (This calculation is imperfect in that it uses private dwellings from StatsCan, from 2001 and 2016, as a proxy for households in 1998 and 2020. It does, however, in an admittedly crude way, demonstrate the scale of the impact of property taxes over time, as considerably more than the cost of dinner out.) Such profound increases are consequential—they have an impact on who can live here and who can’t.

SPIN 3: IT WAS ANOTHER COUNCIL’S FAULT

One of the myths still kicking around the council table last week is that previous terms of council failed to raise taxes enough. This is simply wrong, as the chart above clearly illustrates. This notion ignores the fact that property taxes have increased by an average of 6.7 per cent, each and every year since the County was formed by amalgamation. Three times faster than the rate of inflation.

This rate of increase isn’t benign, it isn’t just another number. It’s a sign our finances are broken. This rate of increase makes it harder to sustain with each passing year, because the compounding effect accelerates. On our current trajectory, the levy will surpass $50 million in just four years—$60 million in just three years after that.

Previous councils had plenty of challenges, but raising the tax levy wasn’t among them. Chief among the critical shortcoming of previous councils was that they failed to fully recognize the challenges thrust upon this municipality as a result of the 1998 reorganization. Like some still sitting around the council table, too many believed they were just a steep tax hike or two, away from financial sustainability. Such delusions have done little to mitigate the County’s challenges.

SPIN 4: TIME TO GET SERIOUS

Last week, one councillor hysterically pointed to the prescience of a former finance administrator who was imploring the council of the day to push taxes higher. The councillor’s contention was that previous councils had kicked the burden of raising taxes down the road and it was now being thrust upon him and his colleagues. Despite the fact that this notion is easily and completely debunked, in cherry-picking those former administrators’ comments the councillor neglected to mention the scores of well-documented examples of folly perpetrated by these folks with taxpayers’ dollars.

Just one example: Early in the last decade, the idea emerged that if we paved all, or most, gravel roads in the County, over time we would save considerable maintenance costs. These savings would accumulate in a reserve and when combined with interest, this pot of money would be used to upgrade them in the future. Colourful and detailed spreadsheets pointed to the coming windfall.

It was a truly wacky and untested financial engineering scheme. Furthermore, it was apparent at the outset that should never have gotten off the ground. Yet, it was heralded by administrators and elected folks alike as a bold and visionary way forward.

By the time the scheme was abandoned several years later, however, the County had accumulated more than $11 million in debt. Road maintenance costs were higher than ever. The scheme had managed only to make the roads problem worse.

The legacy of the accelerated roads plan includes dozens and dozens of forlorn tracks like Closson Road, pocked with craters from end to end. A grader can’t mend them, because they are paved. And there is no money to repair or replace them. So, residents and businesses are stuck with a near undrivable road, and no relief in sight.

There are very few lessons to be learned from the early days of the amalgamated County—perhaps only that delusion of the challenges we face, combined with delusions of our own capacity, have served to push property taxes higher. Yet we remain no closer to financial or operational sustainability. Councillors would be well-advised to look forward than back.

The worst bit of all this misdirection is that it obscures an otherwise sound budget process. There were good stories to be told. Inexplicably, council opted not to tell them.

This kind of journalism does the County a huge service.

Local journalism and news matters for these reasons. Keeping elected officials accountable and breaking through the spin.

To other County media outlets: here is the bar. This is how these things should be covered.