Comment

Uncomfortable facts

The full KPMG report can be found here.

The full KPMG report can be found here.

My recent columns on the County budget have spurred some energetic and fair-minded pushback. This is a good thing. It is, after all, an opinion column and I release these views into the atmosphere precisely to prompt feedback and discussion. This columnist claims no special authority, nor any superior knowledge about the issues and challenges that get aired on this page.

But there are facts. And we must endeavour to root ourselves in facts, even the unpleasant ones, lest we slide into the form of populism where alternate facts thrive. How one wishes to look at such realities is for each of us to decide. Yet it isn’t helpful when we muddy the discussion by saying things that are simply untrue.

One of the more problematic errors in fact, presented to counter my concerns about a runaway municipal budget, is that previous councils kept tax increases artificially low—and that now we must make up for their fearfulness and lack of action.

This is plainly wrong and, troublingly, easy to refute. Perhaps the folks promoting such notions missed the 13 per cent increase to the levy in 2001, or failed to notice the 11 per cent increase the following year, or the 12.6 per cent increase in 2005.

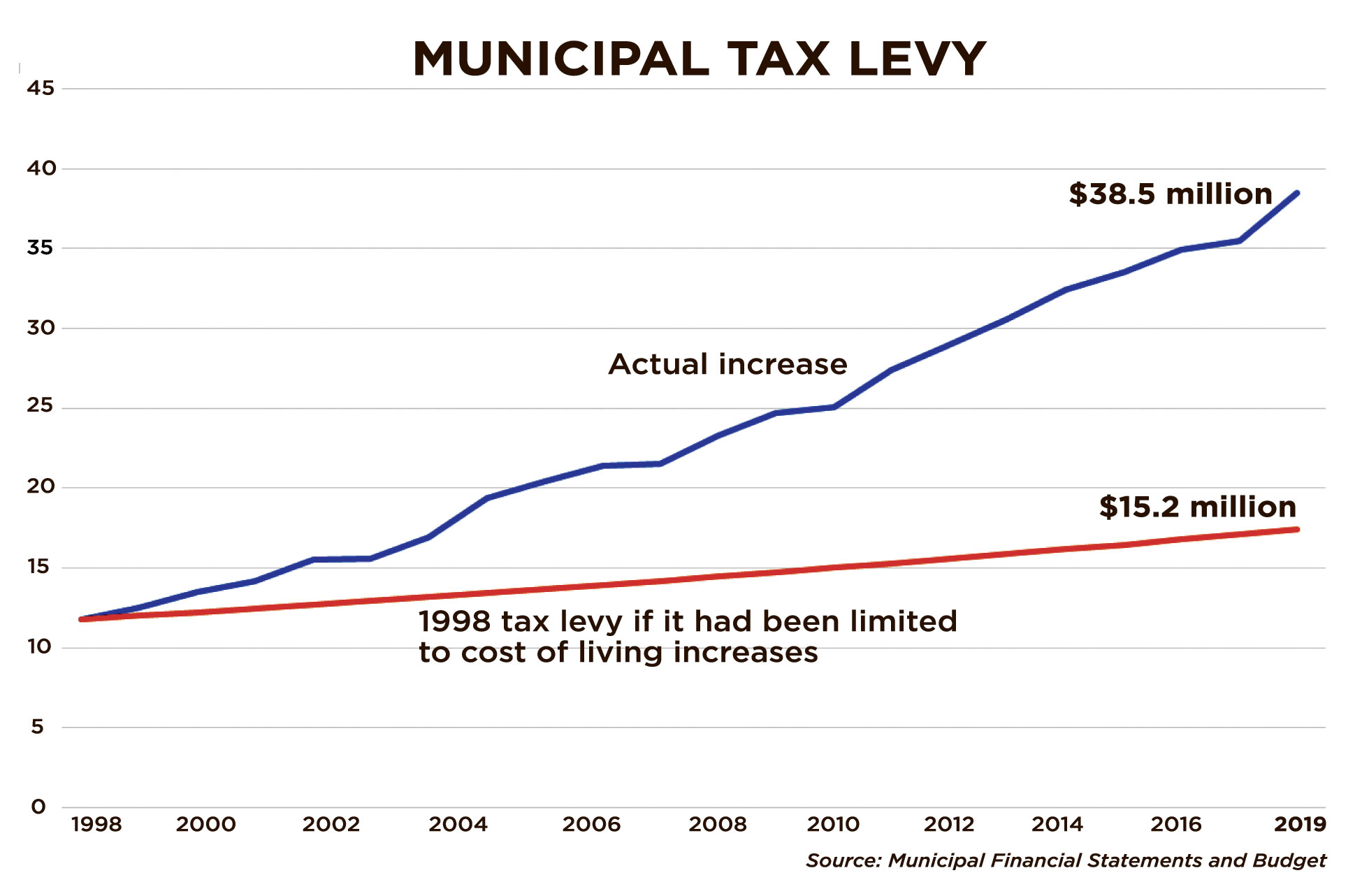

The fact is, the County tax levy has expanded at a rate of more than six per cent per year, every year since amalgamation in 1998. That is three times the rate of inflation over the same period. This means, every year for the last 21, the County government has dug ever-deeper into your wallet to fund its expanding enterprise.

In other municipalities increases to the tax levy of more than two or three percent tend to foment revolt, whereas in the County they seem to float by scarcely noticed. But in our complacency and distracted comfort, we must, at least, pause to recognize, that while some may be able to fund such increases, others are not. As such we are changing our community in a profound and forever type way. Ever-increasing property taxes, along with similarly escalating user fees for such things as waterworks, is making life challenging each year for those living in the margin. Packaging such annual increases as merely an additional few hundred dollars per household is an insult to those who are at the end of their means.

Is this the only force working against these families? Certainly not. But these are two drivers of the cost of living in the County that council controls directly. They cannot ignore the impact their choices are making on these families, simply because others can afford it. Some of us enjoy the luxury of being able to absorb rising property taxes every year. Not everyone can.

One can grouse about previous councils’ choices, but it is simply false to say that they failed to impose hefty tax increases upon County residents.

We must also bear in mind at that there are fewer of us in the County than in 1998. Some readers counter this fact by noting that there are more houses in the County than there were 20 years ago. They are right. Netting demolitions from new homes built, the County has added more than 2,000 new homes over the last two decades. Yet, our population has declined. This means that fewer people are living in each home. Families have been displaced by singles or couples. The poor displaced by the wealthy. This is not a healthy trend. There is no good way to spin this. There is no place to find comfort.

The other myth that must be dispelled is that County taxpayers, if only we committed our tax dollars in sufficient amount, might one day fix our crumbling infrastructure. This, too, is plainly wrong. There are simply too few of us. And the hole is too deep.

As I have described in these pages, many, many times before, we have neither the tax base nor the borrowing capacity in this County to fund our decaying waterworks, roads and bridges. It is simply beyond our collective means.

How do we know this? In 2014, our municipality paid KPMG, a consultancy, to assess our infrastructure needs and recommend a path forward. (See link here.) The verdict was grim. KPMG determined that hundreds of millions of dollars were needed immediately to bring County infrastructure up to a satisfactory level and that many more millions of dollars would need to be spent each year to maintain it. Forever.

We don’t have anywhere near this amount of money. Maxxing out our debt, and tripling or quintupling the tax levy won’t get us anywhere near the amount needed to fill this gaping hole.

Which is why it is bordering on comical when every couple of years council proclaims it is putting another $1 million into roads reserves. That it is getting “serious”. It is equivalent to tossing glass of water on a raging house fire. But it has the political advantage of being seen to have done something.

Is this an argument for doing nothing at all? Of course not. But let us stop deluding ourselves that we are a “serious” tax increase away from fixing our roads and bridges. It is just false.

It never made sense to put this burden on rural municipalities. Yet here we are. In fairness to our municipal staff, they have never denied this reality. Though they could do more to be straight with council, and with the public, about what it can and can’t do. The province downloaded responsibility for much of this infrastructure early in the life of the amalgamated County even when it knew rural ratepayers could never keep them up.

To understand this better, consider that a kilometre of Danforth Road in Toronto may have as many as 150 property tax ratepayers funding it. A kilometre of Danforth Road in Hillier, meanwhile, might have four. It doesn’t work.

So instead, let us have an honest discussion about our infrastructure. As a community. About how we can manage to live within our means.

Some readers felt I leaned too hard on our new council in my budget ramblings. It was not my intention to lay this decades-long expansion of local government at their feet. Having written and spoken about the County’s troubled finances for 15 years, I was—and remain—hopeful that a new group will work to contain the expansionary tendencies of government. I am sorry if they felt this was a personal attack upon them. This is not their doing. But it is now their problem to fix.

The big question I wish to pose to those who are content with the rapid expansion of local government is this: Are you better served in 2019 compared to 1998?

Had Shire Hall managed to limit the tax increase to the rate of inflation, we would be paying a total of $15.2 million this year through our property taxes. Instead we are paying $38.5 million. Is your local government serving you two and half times better than it did in 1998? If the County was an attractive and comfortable place in which to live and raise a family two decades ago, is it doubly so now?

How much is enough? Last month council allocated $20,000 in its first budget to begin looking at new buildings in order to accommodate our expanding local government.

It would be helpful if those who are happy with the current size of government and its growth trajectory could explain to the rest of us how an extra $23 million from taxpayers’ pockets has has made this a better place.

Let me be clear. I am happy to pay taxes. I believe deeply in a robust and responsive local government. By and large, I believe we have that here in the County. But I believed that in 1998 too.

Our local government has expanded at two and half times the cost of living, without a plan, without an explanation or even a target so that we know when enough is enough. Ratepayers deserve to know where we are going and how much it will cost.

Ultimately it comes down to this: When municipal tax increases outpace your income and the rate of inflation, alarm bells should go off. When it does so for two decades, complacency seems an inappropriate response.

How does government justify increasing its size when the population of the municipality is decreasing?

I would be curious to find out “what” these increases have been spent on ….is it all Provincial downloaded costs or other things. A study by KPMG on what we need is one thing, a study on where the money has been spent might also be interesting. And correct, I have heard a number of people complaining about the increase this year…which as you noted has been going on for 20 years.

Ideas to possibly consider:

Double tax (mill rates) for non residents. AND

charge commercial tax rates on STA operations (they are commercial businesses after all)

Current market value assessments (level the field)

Crack down on property tax fraud (fake farms)

Curtail the growth of local government. (Why is it growing?)

Pursue new industry in the County that will pay more than minimum wage.

Again, Rick, you avoid bring up the 110% tax increase experienced by our farmers. You were the main voice supporting this increase and extra burden, but now you are slamming an 8% increase? Where were these facts and figures last year when you told farmers to suck it up and pay up?

Provincial downloading is a major contributor to this dilemma (roads, water, health care costs etc) good luck getting any relief from the present Provincial government.