County News

‘We have to’

Council approves massive hike in taxes to pay for roads

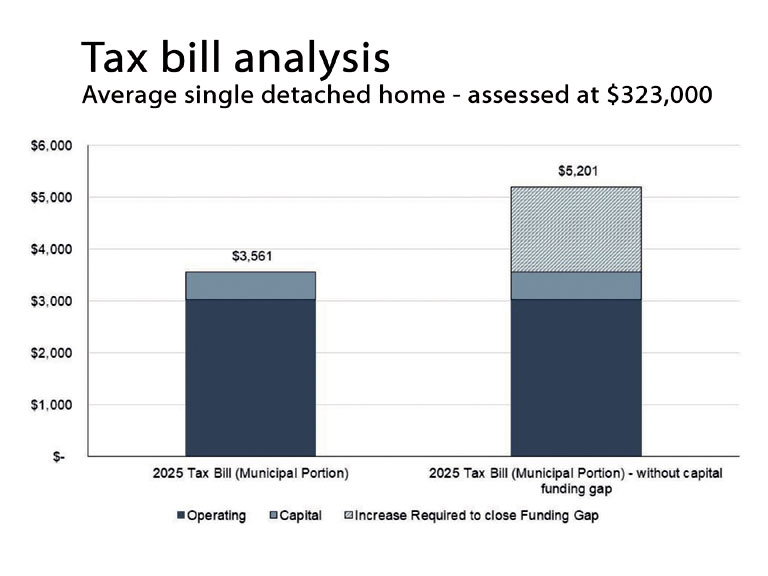

Acommittee of council approved, last week, a 46 per cent hike in the average County property tax bill— phased in over a decade. It did so in an attempt to close its infrastructure funding gap—a gap is defined as the amount of reinvestment needed to maintain County things such as roads, bridges and buildings.

Shire Hall figures it needs to spend $36 million each year to ensure its assets don’t crumble faster than it can fix them. It currently spends about $11 million annually. The difference, $25 million, is roughly the size of the hole Shire Hall is hoping to fill.

The province isn’t coming to help. Nor is the federal government. Shire Hall’s consultants say that County property taxpayers must fund this gap. The average annual tax bill in the County is $3,561 (not including the education portion). It should be $5,201 according to the consultant. It is the scale of tax increase needed to fund the municipality’s things.

The consultant, Watson and Associates’ Peter Simcisko, explained that other municipalities are dealing with similar funding challenges. That made some council members feel better.

One hundred and sixty-four respondents to the consultants’ survey indicated “a strong preference for increasing taxes to maintain existing service levels”. This, too, made the councillors feel better about the task at hand.

The consultant illustrated that by adding $1,550 to the average tax bill, the County would still be in the middle of the pack of 127 municipalities selected by the consultant. Good enough for most council members.

Having spent the day listening to its consultants and staff, Council was persuaded it had no choice. The province was telling them to do so. The consultant said it was okay. Finance staff have been working on the plan for months.

Council had to hike taxes. So they did.

The only questions remaining: 1) where to spend all the new money, and 2) how to sell a whopping tax hike to unsuspecting residents.

Councillor Janice Maynard led a cohort who insisted the bulk of the windfall ought to be used to improve municipal roads—the largest asset category and, by far, the hungriest for tax dollars. Roads were always going to be the primary beneficiary of new tax revenue, but Councillor Maynard managed to persuade her colleagues to opt for the premium package—committing nearly $26 million every year to this asset class. In for a penny.

All other asset classes combined won’t see the reinvestment Council has made to roads. If adopted and implemented in budgets for the next 10 years, the County will be a road reconstruction business that does a few other things on the side.

But when the moment came to approve such a massive tax hike, Councillor Maynard balked. She wasn’t sure it was a good idea to make such a momentous decision at the end of a long day.

“I am not ready to make this decision,” said Maynard. “I would like to digest this.”

Her colleagues persuaded her otherwise.

South Marysburgh councillor John Hirsch was convinced there were just two options on the table: “Let the place continue to fall apart, or we can get with a scientifically designed program.”

Hirsch agreed that phasing the whopping increase over 10 years would make the selling easier. Gradually. Steadily.

By 2035, this plan will consume $110 million in property taxes (from $54 million in 2025). But rather than gobble it all at once, the valve will be opened gradually. Instead, the tax levy will rise by 7.4 per cent. Every year. Compounding each year.

But wait, there’s more. New homes may enable the municipality to spread the cost across more taxpayers. Consultants figure that assessment growth could get that average increase down to 5.5 per cent, if all goes well.

That sounded better.

“Council will have to speak with one voice to persuade the public that this is a good idea,” said Hirsch.

Councillor Kate MacNaughton was unsure that it would be enough.

“The public is going to have difficulty understanding confidently that we are doing the best we can,” adding that good communication was critical.

MacNaughton lamented the fact that the burden will fall predominantly on residents. Unlike other comparable municipalities, the County has a puny industrial and commercial tax base upon which it can lean.

“With or without economic development, that brings commercial development, we still have to raise taxes in order to manage what we own,” said Councillor Mc- Naughton.

Mayor Steve Ferguson suggested that if residents knew what Council knows, they would get on board the tax hike train.

“The public needs to be aware that where we are today aligns with other municipalities in terms of the gap, generally speaking,” explained Mayor Ferguson. “Every municipality in the province is going through this process. I don’t know that the public understands that this is something we have to do.”

Perhaps if the Mayor would resume his “Community Conversations” we would “already be aware of where we are today”. Three Ward conversations were held in 2023, two were held in 2024, and nothing since then. Time is marching along, Sir…

“Mayor Steve Ferguson suggested that if residents knew what Council knows, they would get on board the tax hike train.

“The public needs to be aware that where we are today aligns with other municipalities in terms of the gap, generally speaking,” explained Mayor Ferguson. “Every municipality in the province is going through this process. I don’t know that the public understands that this is something we have to do.””