County News

Just money

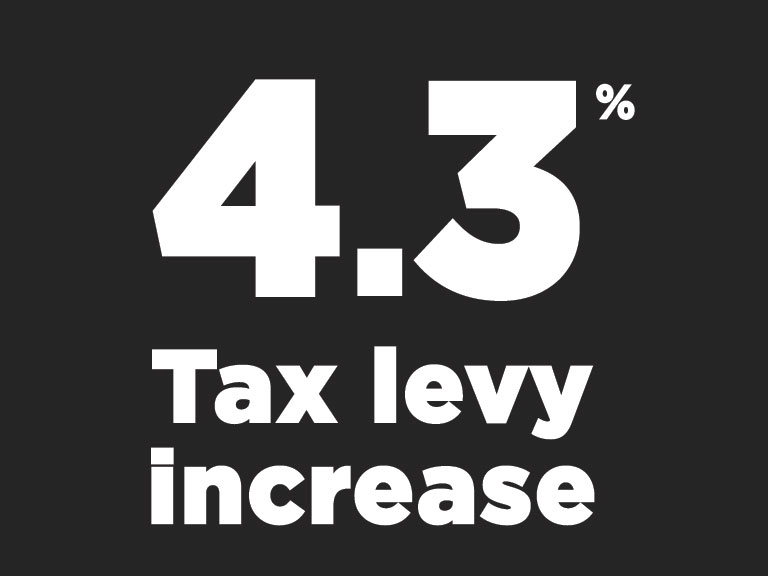

Council approves 4.3 per cent hike in tax levy

It’s just money,” said the commissioner of works. It was an ever-so-small crack in Robert McAuley’s otherwise stoic demeanor in the week-long dissection of the County’s budget. A councillor had wanted to know how he could move a road in his ward up the repair and reconstruction list. It was a rookie mistake. More experienced councillors know it is useless to go headlong into the budget fray with roads demands based on logic and economics. There is more art to it than simply making a good argument— it requires persistent low-level lobbying, a healthy dose of sucking up and then the plea for pre-eminence on the basis of a) safety or b) County self-esteem, as in “Highway 49 is an embarrassment.”

In the end, of course, the works commissioner was right—yet the choices council makes each December ultimately affects people’s lives. For some, the rising cost of water, garbage and property taxes mean trade-offs with other more malleable expenses—like food and clothing.

On Friday, council approved a 2017 tax levy of $33.7 million, that’s an increase of 4.3 per cent over the $32.2 million collected from property tax payers this year. The tax base grew $0.3 million (mostly new homes) in 2016, which reduces the net tax increase in 2017 to 3.3 per cent.

Since the County was amalgamated in 1998, the tax levy—the amount raised from property tax payers to fund County government— has increased at a compound average rate of 6.3 per cent per year (removing the effect of increases stacked on increases). Local government is growing faster than the cost of living of families in the County. Every year since amalgamation, nearly 20 years ago, Shire Hall has claimed an ever-larger portion of residents’ wallets.

It’s just money.

Council mostly ducked the issue of the futility of the County’s infrastructure deficit in the week-long budget marathon. Not that Chief Administrative Officer James Hepburn didn’t try—noting on several occasions that the County was digging its hole $38 million deeper each year, while tossing just $10 million or so into the abyss annually.

Yet, many council members either don’t understand the impossibility of its infrastructure challenge or live in a form of denial—focused so intently on their ward’s road needs they are unable to see the big picture. Some are really keen to throw many more taxpayer dollars into the hole.

“We have to dig in,” said Athol councillor Jamie Forrester in support of an addition $1 million to be collected from ratepayers to be put into the roads reserve. “Can we afford it? No. But right now all we are doing is waiting for the fairy to come out of the sky. Some council will have to fix these roads. At some time they will crumble around us.”

Despite the brave rhetoric, throwing another $1 million into a $600 million hole doesn’t change basic fact that there is no earthly way the County—through taxation, borrowing or user fees—can patch its crumbling roads fast enough. No amount of “digging in” will change this. Yet, there is no shortage of councillors willing to try—willing to carve “niceties” from the budget to fund the insatiable roads beast—niceties including improvements to the Millennium Trial, repairing tennis courts and fixing Picton parking lots.

Councillor Jim Dunlop opposed the added tax levy, noting that it would push the tax levy increase over 7 per cent. Other councillors argued for cutting services and programs to fund roads.

It posed a bit of a philosophical crossroad.

“The budget should tell a strong leadership story,” said Sophiasburgh councillor Bill Roberts. “What is the story of this budget? We need to define it, so we can convey it to the public. I think Jim (Dunlop) is trying to get to that.”

County manager James Hepburn described it as a transitional budget. Earlier this summer, council approved a new corporate strategic plan—setting a direction for the County for the next five years.

“There is no question that we are trying to lay the foundation to our plan,” said Hepburn. “This budget gives us the tools and resources to do this.”

For a majority of council this was a story they could tell to residents. They nixed putting $1 million more into roads. They approved $150,000 earmarked specifically for financial sustainability planning— much of it to be targeted at meeting requirements of senior levels of government for project funding. They agreed to put in as much as $185,000 into the Millennium Trail—pending grant approvals— alongside $80,000 raised in the community as part of a $450,000 restoration project along the 49-kilometre length of the trail.

Council also agreed to hire new folks in its finance department and community development, specifically targeting the goals set out in its corporate strategic plan. Community development is also assuming direct responsibility for visitor services in 2017 and will hire a coordinator to manage this function, previously contracted out to the Chamber of Commerce. This is expected to be a cost neutral addition—bringing an outside service into Shire Hall.

It has put $50,000 aside to fight for the title to Hillier roads—precipitated by the erection of a gate across Pleasant Bay Road in May, barring public access to the bay.

Council also approved $125,000 for an Ontario Municipal Board hearing to examine its decision and process regarding the size of council.

MIXED HOSPITAL MESSAGE

There were a few decisions that will likely prove a bit harder to explain. Among the more perplexing, was council’s decision to cut the hospital foundation’s request of $60,000 in half—putting just $30,000 toward the new hospital project.

South Marysburgh councillor Steve Ferguson reminded his colleagues that 20 other communities are in the hunt for a new hospital. He said it was crucial that Queen’s Park see that the municipality is committed partner in the project.

“Let us show them in the form of dollars,” said Ferguson.

Councillor Roberts was more blunt.

“Trenton (council) gives $3 per capita, Belleville gives $6 per capita. Lennox and Addington contributes $50,000 each year” said Roberts. “In Prince Edward County, it is a goose egg. Since 1999, the County has contributed a total of $1,170 to its hospital foundation. We are way behind.”

Several council members were thrown by the Foundation presentation suggesting that some of this money would be used to fund a study to measure this community’s capacity to raise the needed funds for a new hospital.

“I don’t want the money spent on a stupid study,” said Councillor Gord Fox. “I want it to be used for something useful.”

Even after it was pointed out to Fox and others that other communities have completed such a study or are in the midst of doing so—that it forms part of the business case—most council members remained unwilling to fund research.

Some proposed establishing an internal hospital fund—separate from the hospital foundation. Others proposed earmarking municipal funds exclusively to be used on equipment.

Councillor Forrester urged his colleagues to rely on the provincial government to do the right thing.

“I hope our government will put new hospitals in communities that need them the most—not places who can raise the most money,” said Forrester with a straight face.

GETTING WEIRD

Another odd debate centred on funding for the Regent Theatre. The Picton stage receives about $38,000 each year from the municipality to help keep the lights on. Most previous councils have seen this as a reasonable way to keep the strategic asset open—while avoiding municipal ownership. But this term of council wants out of its support of the theatre.

The debate got off to a particularly clunky start when one senior member of council explained she could not continue to put taxpayer money into a private business. The explanation that the Regent is in fact a not-for-profit organization guided mostly by volunteers didn’t alter the councillor’s view.

In the end, council reduced Regent funding to $35,000 and signalled its intention to ratchet down funding by $5,000 for the next seven years. They called it weaning.

WHY TOURISM?

Among the more dispiriting budget debates surrounded economic development. Hallowell councillor Brad Nieman wanted to know how tourism benefitted County residents—other than clogging up roads and streets a couple of months each year.

“If taxpayers aren’t benefiting, why are we doing this?” asked Nieman.

CAO Hepburn responded by first pointing out that tourism is a core tenet of the Corporate Strategic Plan Nieman and his colleagues adopted just a few months ago. Further, he explained that tourism drives the County’s commercial sector, creates jobs and builds the tax base.

“Stopping tourists from coming to the County would not be productive,” said Hepburn, raising understatement to an art form.

The Director of Community Development Neil Carbone added that tourism growth is driving growth in many other sectors of this economy.

There were several contenders for the title of weirdest debate however. Mayor Robert Quaiff stopped the meeting at one point on Friday so the director of finance could calculate the effect of the proposed levy increase per $100,000 of average assessment. Soon enough, the answer was computed—$ 30.96. But what is average? If residents heard this number, would they understand what average meant in this context, wondered some council members? After all not everyone is average— nor do their homes have an average assessment. The nature of averages is that some are above average, some are below. Some are average.

“Could you calculate a band, a range of increases?” asked a councillor. “A band of what?” asked the County manager, truly perplexed by the question.

Comments (0)