County News

2026 budget book is out

Higher taxes, a growing mountain of debt, lots of road ambitions

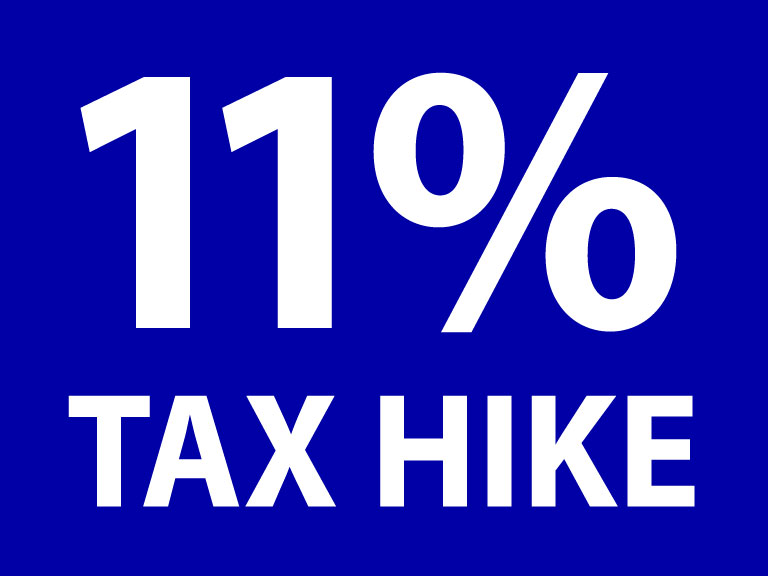

The 2026 municipal budget, as prepared and presented by Shire Hall leadership, calls for an 11 per cent hike to the property tax levy next year. After extracting $54 million from property taxpayers this year, the municipality is looking to raise $60.1 million next year.

From the 2026 budget book: “The most significant budget pressures the County anticipates in 2026 include negotiated increases in wages and staff benefits, inflationary growth in fuel, utilities, and contract costs, continued supply chain challenges, and rising prices for construction, parts, and supplies.”

On the capital spending side, there are two categories of projects: continuing and new investment. Continuing spending involves projects that span a year or more, or those where the desire exists but the funding is lacking.

The proposed 2026 budget tallies continuing spending of more than $167 million in this bucket. The rebuild of the long-term care home in Picton will consume about $97 million of that. However, County Road 49 is also on the list, at $44.5 million. Both of these need funding injections from the province. The long-term care home already has a commitment of about $60 million from Queen’s Park, but its contribution is being paid out over 25 years (meaning County taxpayers must carry this debt for the term).

Meanwhile, Shire Hall needs the federal government to pony up $20 million or so to get County Road 49 shovels in the ground. Just $20 million has been spent so far on Shire Hall’s list of continuing projects.

The other capital bucket is new investment: Shire Hall intends to add $23 million in new capital spending, including a fresh $14.1 million injection for roads next year (on top of about $8 million earmarked in the continuing bucket for roads). It identifies about $2.8 million for bridges. Land improvements and building upgrades are set to receive $2.3 million in new investment next year. Replacing trucks and equipment will add another $2 million to the capital budget.

All of this means that debt will rise sharply next year, from $71.2 million to $131.2 million. It means that borrowing costs (interest and principal) will increase from $4.8 million this year to $6.2 million in 2025.

Shire Hall is refreshingly direct in its discussion of debt management.

“The County does not have a clear debt strategy. Instead, the municipality relies on a mix of provincial and federal funding opportunities, ongoing updates to asset management plans, potential policy changes based on affordability pressures, and general cost-control efforts.”

COUNCIL’S TURN

From here, the proposed budget will come under scrutiny from council members. The review begins with a summary presented by the municipal treasurer on the evening of December 1. Daylong sessions will follow on the 2nd and 3rd of December.

FAMILIAR CONTEXT

When the County amalgamated in 1998, the tax levy was $10.3 million. The population was about 25,000 people. Next year, the tax levy will be $60.1 million. The population is still about 25,000 people. Many of whom live on a fixed income.

Since amalgamation, the tax levy has risen relentlessly, averaging an annual increase of 6.5 per cent since 1998. Meanwhile, the inflation rate in Canada has averaged 2.14 per cent over the same period. Shire Hall has never managed to live within its means, and 2026 will be no different.

WATERWORKS UTILITY

The cost of operating the six water and two wastewater systems is expected to rise by 9 per cent in 2026 to $7.2 million, compared to this year (the cost of electricity needed to pump Picton waste up and down the hill continues to confound the wastewater treatment operators). New capital investments are projected at about $7.4 million. They include the reconstruction of Barker Street in Picton, the removal of the old Wellington water tower, and the construction of a booster station to increase water pressure for customers in the Pineridge subdivision in Picton.

The waterworks’ list of continuing capital projects is where the big money—and all the risk —resides. The 2026 budget book still carries the Wellington water plant at $25 million and the Wellington wastewater plant replacement at $23,600,000. Both are estimates based on 2021 calculations and certainly won’t bear any likeness to the eventual cost, if/when these projects are tendered.

Why? In 2021 (in the same report), the trunklines project in Wellington was projected to cost $12.3 million. Between that engineering estimate and the drafting of tender documents to do the work, Shire Hall learned it needed a pumping station at the top of West Street. (It’s the sort of miscalculation that throws big capital projects off course, especially with projects of this unprecedented scale for this community.)

Today, the project is months overdue and is unlikely to be completed until fall next year. The current cost estimate, gleaned from the 2026 budget book, is $26.1 million, more than double the 2021 estimate. The tally for this project is likely still growing.

Even though just four new homebuilding permits were issued in October, putting the County on its lowest track for new homebuilding since 2016, the authors of the budget book remain bullish about the prospect for new homes.

“Most new growth is happening in Picton. Development in Wellington is expected to resume once additional water and sewer capacity is available,” according to the 2026 budget book. It seems more wishful thinking than an accurate reflection of the current market or data. It’s a worrying blind spot.

Will someone explain this 11% increase, please? I’m not a “numbers” person, by any stretch.

What happened to the 7.4%, every year, over 10 years? Is this now to be 11%, every year, over 10 years – until the next 2027 Budget, where there will be yet another increase, every year, over 10 years?

See the W-T article dated September 24, 2025:

https://wellingtontimes.ca/we-have-to/

“By 2035, this plan will consume $110 million in property taxes (from $54 million in 2025). But rather than gobble it all at once, the valve will be opened gradually. Instead, the tax levy will rise by 7.4 per cent. Every year. Compounding each year.”

With a taxpayer base in 2025 of 16,467 – many fixed income seniors – explain how we are going to pay for this. Or is this Council just waiting for us to “pop our clogs” and our kids can shoulder these increases?

An Independent Staffing Review is a prority. The organization is too heavy and needs to make appropriate reductions. It’s not the Municipalities role or function to be the top employer in the County. Why Council is fearful or reluctant to address this is puzzling.

I do not know if anyone has taken the trouble to ask Council to conduct an “Independent Staffing Review”, so I’ve taken the liberty of sending our Council an “Open Letter” asking them to do this. We’ll see.

xxxxxx

MEMO TO: Mayor Steven Ferguson and Council

COPIES TO: Residents, Wellington Times, Picton Gazette

SUBJECT: An official request for an Independent Staff Review

DATED: November 25, 2025

Will someone please put forth the following as an “Item for Consideration” at the next Council meeting: I am requesting an Independent Staff Review to be conducted ahead of the 2026 Election – with the results being provided before that election. This has been mentioned a number of times in the local media, by residents, but I’ve no idea if anyone has approached Council. A response from Council would be appreciated.

This resident has an excellent point – why hasn’t this issue been addressed?

“The latest example: Wellington Times: Nov 23, 2025 at 6:52 pm Fred

An Independent Staffing Review is a priority. The organization is too heavy and needs to make appropriate reductions. It’s not the Municipalities role or function to be the top employer in the County. Why Council is fearful or reluctant to address this is puzzling.”

xxxxxx

We don’t need more reviews.

We need to fire half of our council and most of the management at Shire Hall

Councilor cannot be fired in Ontario.

But if you run for Mayor and win, you could certainly reorganize Staff, including all sorts of top heavy positions.

Give it some thought. And that goes for anyone else who thinks $100+ MILLION dollars a year is way too much for municipal government to spend in a County of 25,000 people.

Reference: https://www.ontario.ca/document/ontario-municipal-councillors-guide/10-strong-mayor-powers-and-duties

“Appoint a chief administrative officer

The head of council can choose to appoint their municipality’s chief administrative officer.

Hire municipal division heads and change organizational structure

The head of council can hire certain municipal division heads — excluding statutory positions. Positions that are excluded from this power include:

– the clerk or deputy clerk

– a treasurer or deputy treasurer

– an Integrity Commissioner

– an Ombudsman

– an Auditor General

– a registrar, as described in section 223.11 of the Act

– a chief building official, as defined in the Building Code Act, 1992

– a chief of police, as defined in the Police Services Act

– a fire chief, as defined in the Fire Protection and Prevention Act, 1997

– a medical officer of health, as defined in the Health Protection and Promotion Act.

– other officers or heads of divisions required to be appointed under the Municipal Act, 2001, the City of Toronto Act, 2006, or any other Act

– any other persons identified in regulation

The head of council can also choose to create and re-organize the structure of the municipality.

When making any changes to the organizational structure of the municipality, the head of council and municipality are subject to legal requirements including any terms in existing collective agreements or contracts that may apply.”

So, even with these constraints, LOTS can be done to right-size the organization.

We do not have the right to “Municipal Recall Legislation” – we should have, but we don’t, and as the steps to gain that right (which a province out west has done, by the way), are onerous and nobody in the County is prepared to take this one on. And, once it has been gained, it will be far too late to get this Council out.

No one likes to see an increase in their property taxes…or any taxes for that matter. There are only so many ways that a municipality can fund its operations: debt, taxes, investment income and grants from other levels of government. Notwithstanding the Times opinion articles regarding tax increases over the years, this community appears to be taxes at a lower ‘rate’ than its neighbours. If one were to take the assessed value of one’s urban home in the County and apply the mill rate in say Quinte West, Belleville or Kingston one would find that one’s property tax bill would be substantially more than in the County. I looked at the background material regarding the proposed tax increases. These increases are to address shortfalls regarding for instance roads. They are being phased in over 10 years. Yes there will be higher tax bills. On the other hand using current assessed values and the phase in plan, I calculated that at the end of that 10 year period (accounting for compounding as well), one’s tax bill would approximate what taxpayers in Quinte West and Belleville are paying today!. Keep in mind that their bills will increase as well even if only by the rate of inflation. Sure, the tax increase could be cut back to the rate of inflation. In that case don’t expect to see your roads fixed and likely expect to see a decrease in service. Increased costs suck, but you can’t get something for nothing. I know this opinion will not be popular. So be it.

Quinte West. Belleville. Kingston.

The last time I checked, the County of Prince Edward Draft 2026 Budget was for Prince Edward County. Full stop. These cities have their own Mayors, their own Councils, their own taxpayer base, and their own budgets, and quite frankly I couldn’t give a toss. I’m concerned with PEC.

A place where the vast majority of property owners are seniors on fixed incomes with little to no hope of a cost of living increase. Quinte West, Belleville and Kingston cannot compare to our situation. We have no industry (the largest employer in The County was the mushroom factory, which shut it doors on us just this year – or did you not notice?) and most jobs, when available, are either part-time, or seasonal and in any event, pay below the poverty line or just marginally above it – forget benefits. In the twelve years I’ve been here, my taxes have doubled with no increase in services, there have been local schools that were closed due to lack of families – who either had to move out, or couldn’t move in due to lack of jobs and the prices for rentals, and the housing costs developers are demanding on their new homes – when they even deign to build them despite all the concessions that the Planning & Development Committee give them (that’s our Council members, by the way). I’ve met workers from Bell and Hydro who are living in STA’s off-season, and kicked out to fend for themselves when the tourist season begins. Nice one. In that same twelve year time-frame grade school children had been moved to the Picton high school (not a wise move no matter how you look at it). Staffing at Shire Hall is out of control by any definition, and the salaries are completely out of line in the last seven years with absolutely no growth in population to account for it. Many senior management positions are new since the 2018 election, and their salaries are in the $100,000.00 range, and climbing. (And no, I’m not saying they don’t earn it, as I’m pretty sure most certainly do – we just appear to have too many for our circumstances.) All of this on the backs of mainly residents on fixed incomes, and small businesses struggling just to survive – who, I believe, now have to pay to have their recycling picked up. If that’s correct, then that’s another loss in service with an increase in cost. So no. I don’t buy your comparisons.

Quinte West, Belleville and Kingston vs. the situation in PEC – unless I’m missing something here (and I may very well be – wouldn’t be the first time after all), this is all comparing “apples and oranges”. Out of the four locations, we are definitely in a unique situation, so please stop with the outside comparisons and just look at our own situation since the 2018 Election. The escalation in salaries in Shire Hall, no increase in services, and the hike in our taxes which appear to be primarily benefiting staff salaries at Shire Hall, will do for a start.

And just in case you missed this one, here’s a little Fact Check from another resident in PEC covering the period 2019 to 2025. Same Mayor. Same CAO (who departed in May of 2025 along with other senior members of staff):

‘

No. of PEC employees earning more than $100K:

2019 – 19 employees

2025 – 62 employees

No. of Directors at Shire Hall:

2019 – 2 employees

2025 – 10 employees

Note: 9 earn over $150K

Total PEC salaries:

2019 – 24.3m

2025 – 34.7m

Note: 40% increase in 6 years

It’s your taxes. Think about it.

And to top it all off in grand fashion, on March 4th, 2025, I made an Action Request through the Shire Hall website. My question was concerning the population numbers of taxpayers for PEC for EACH of the years from 2018 to present. The response was enlightening:

I was informed that the following is an approximate count based on the number of bills printed in each of the following years.

2025- 16,467

2024- 16,357

2023- 16,050

2022- 16,712

2021- 15,107

2020- 14,843

These are the people whose property taxes are keeping the lights on at Shire Hall.

Still think we’re getting a good deal?

SM:

As Teena said, the key issue here is not to focus on what other municipalities do, or don’t do, That is a typical distraction technique used by people in the County who seem to favour the current Mayor and Council’s decisions (or lack of decisions). If you want to live elsewhere, then by all means sell (if you can), and exit the County.

Strictly looking at the County, the annual Operating spending (especially Salaries, Contracted Services and Materials and Supplies) have gone through the roof — over $100 MILLION a year run rate at present, and growing far faster than inflation. And all because of the decisions (or lack thereof) by the current Mayor and Council.

And while everyone can agree that “Increased costs suck” and “you can’t get something for nothing”, the real problem here in the County, is that service levels have NOT improved with the increased spending — in fact most people who live here full time would say they have gotten WORSE.

Clearly you are in the category of people who are not bothered by such increases. Perhaps this is because you are independently wealthy, or perhaps because your assessment is so low that the percentage increase does not matter to your personal budget. Or perhaps you are taxed at agricultural rates, which are MUCH lower than regular residential rates. Regardless, you are certainly entitled to your opinion. But you are not entitled to your own facts. The facts that matter are what the County is spending, borrowing, and taxing.

An article published today [Nov.24/2025], and is well worth paying attention to. This is a local, long-time resident, who definitely knows a thing or two. I only wish the Mayor and Council would pay attention and act appropriately:

“Put The Brakes On Spending”

Indeed.

https://www.intelligencer.ca/opinion/columnists/way-back-when-separating-your-wants-from-your-needs

Municipalities are a Provincial entity; the Province says jump, we jump. There are many huge expenses that the Progressive Conservative provincial government doesn’t want to pay for, but we almost exclusively blame our own staff for mismanagement rather than the province. For example ;

• Bill 23 from 2022 eliminates many developer fees, so the city pays for growth.

• Provincial downloading of infrastructure responsibility (CR 49) from the Mike Harris Conservative Ontario government in the 90’s (with a whole 3 years of provincial funding) means we have to maintain that expensive infrastructure today at great cost.

• MPAC assessments are frozen from 2016 so every landowner who has bought properties in the County since then isn’t paying their fair share in property taxes. I bought for 450k last year but I’m assessed at 300k, allowing me to save a few hundred bucks a year. If my place was a $4 million dollar home, it saves me $250k / year. I’m happy to pay a few hundred more if the rich have to pay a few HUNDRED thousand more, however the Ford government keeps delaying this assessment.

• Bill 6 in 2025 increases police spending to clear homeless encampments. Bill 33 puts police in schools and removes school board trustees. Bill 40 hikes electricity costs for Ontarians while subsidizing it for large tech companies and Data Centers. And if you’re not happy with how the government is running things, Bill 68 allows them to remove fixed election dates and remain in power another year, with full control on when the next election will be.

• Asset management requirements from the province (eg; we’re required to spend 100k on adding a washroom to Jack Taylor park, or we lose funding. We’re also required to maintain our roads to a minimum quality level, which is why we are finally biting the bullet and funding CR49 repairs).

All these are provincial decisions are major drivers of municipal taxes, and we overwhelming vote Progressive Conservative in Prince Edward County, then wonder why we have to pay for infrastructure and healthcare out of pocket. A majority government of ‘Progressive Conservatives’ is not a democracy when they have unilateral control over our wallets; it’s an 80 person dictatorship.

I’ll see you all in 5 years to vote NDP provincially if we’re still in a democracy.

Karim, regardless of what you say regarding upper levels of government, the municipality 100% controls how much it spends.

In the year ended Dec 31, 2024, the County spent over $96 MILLION on operating expenses. The financial statements are here, you and any member of the public can have a look –> https://www.thecounty.ca/residents/services/finance/#financial –> Scroll to Financial Statements, and select the year(s) you wish to look at.

Those decisions were made, 100%, by the Mayor and Council. Staff spent the money, but the Mayor and Council approved it.

The important election is NOT the Provincial one in 5 years. The important one is next October, when the electors in the County have an opportunity to elect a Mayor and Council that will right-size the spending.

Everything else is just distraction.

If the electors in the County continue their practice of electing people who do not have the skills, the courage, and the will to right-size the spending, then nothing will change. Actually, it will get worse now, exponentially, because of the huge NEGATIVE net worth, the increasing interest payments the County must make to the Province, and the decreasing grants from the Province and the Federal government because of the US War of 2025.

The municipality is not blameless, but there is only one line on this article that correctly pins the CR49 costs on the Province, and nothing else on how much of these costs (Roads, Healthcare, Housing, etc…) stem from the Province downloading these costs TO various cities. The County, along with many other municipalities in Ontario, are financially running on fumes.

The Federal Liberal government is forcing us all to tighten our belts due to austerity measures while the Provincial Progressive Conservative government is actively picking our pockets. All level of governments are responsible, but the largest problem lies with the Province underfunding cities across Ontario, leading to property tax increases and/or service cuts.

There is absolutely NO WAY! that I’ll give this Council a “free pass”. The “buck stops here” Mayor Ferguson, and I, for one, am looking forward to our next municipal election (October, 2026). Many of us will be watching this one very closely.

When the County prepares a budget, it determines how much must be raised through property taxes. Taking, business and commercial taxes out of the equation for the sake of simplicity, the County ends up with a total revenue requirement. As it has the ‘total’ assessed values of County residential properties, it basically can divide the revenue requirement by the assessed values to come up with the mill rate. If properties are re-assessed and the total value increases, the mill rate will be decreased to compensate so that the same total revenue is achieved. If the total value decreases the mill rate will increase. When a property is sold ‘today’, MPAC assesses the value to a comparable 2016 value. If they did not do so, everyone who buys a property today at a much higher cost than in 2016, would be to put it bluntly “screwed”. Bottom line is, your taxes increase based upon revenue need not necessarily upon the assessed value of your home.

Gary, this may actually be the current Mayor and Council’s strategy (at least a sufficient number of Councilors to ram through the decisions (and indecisions) that are driving the massive spending spikes.

After all, when a house is sold, the new buyer will then be taxed based on an assessment that will be much higher, because then it will be based on the sale price.

So, in effect, an exodus of long-time County residents will mean much larger assessments and thus much larger tax bills (for the new buyers). They won’t like that, but what can they do? Nothing except maybe wait a few years and then exit the County themselves.

The only possible solution to this is for at least 14 people who are willing to say “stop the madness” and stand for election in the Oct 2026 election. We will soon see if that is true.

The current occupants of the Mayor and Council chairs are unlikely to rein the spending in, based on their track record over the past term (and beyond, for many).

Just on Salaries, Wages and Benefits alone, for the year ended Dec 31, 2024, the County spent $34,734,661. That’s almost $1400 PER PERSON for a population of approximately 25,000. Scandalous. And much, uch higher than almost any other Ontario municipality.

And that figure has already spiked up, to be sure, because it would not include the severances paid to departing members of the senior Staff in the year 2025, thus far.

The massive spending is being driven by the urbanization effort of developers and outside consultants, all of whom are seeing their asset values rise nicely, with every dollar the County spends on infrastructure that it does not need, because the wild projections of growth for the County are pure fantasy and unsupported by any logic.

Absent at least 14 people who are willing to say “stop the madness” and stand for election in the Oct 2026 election, parachute-packing time is coming for anyone who is unwilling or unable to continue parting with ever-increasing property tax and water use dollars.

This all seriously escalated when the present Mayor and most of the existing Council decided to hire an Urban Planner as our CAO shortly after the 2018 election, and then there was a questionable and unchecked increase in senior staff levels (a few who left immediately after her departure, by the way – accountability and transparency are absent in Shire Hall – then and now). I do believe the CAO did the job she was assigned to do, and did it well. But an Urban Planner as CAO, governing all staff, in a primarily Rural setting? The senior staff appear very qualified to do their jobs, by the way. However, the question remains, how many of these various levels of municipal governance do we really require? The cost is far too high. Shire Hall is bursting at the seams, and requires outside office space, but the population hasn’t changed. And who is the idiot that decided a developer should have a signed contract by Council and the Mayor, that gives them direct, in-house access in Shire Hall because they are paying the salaries of three staff members (although I believe that number is now four)? If this is an annual contract, can it be discontinued? Should it be discontinued? How many other developers would like to do this? Silly me. I thought Shire Hall was for the residents.

Thus the dire need for an Independent Staffing Review. And further the Picton Ward needs to dump our 2 Councilors who support everything woke that comes along. They take up at least an hour at every Council Meeting to hear themselves speak and spew nonsense. They have really assisted in putting us in a financial crunch. We need more Councilor Neimans!!!

Picton Councillors – in the 2022 election Councillor St-Jean accepted a campaign donation of $1,000 from a very active Picton developer. How did that escape the scrutiny of the Audit Committee? The financial statements from the candidates weren’t released by Shire Hall until the following May. Unless you remember and check, you don’t know who is backing our elected officials. How many times has this Councillor declared a Conflict of Interest regarding this donation, regarding this developer, in this four year term? I can tell you now. No declarations have been made. If they’re not made, and you don’t check the website, you don’t know. Accountability and Transparency? Nope. Nothing to see here.

Last 3 Councils have relieved the CAO. Dewing 2018 term, Hepburn 2022 term, Wallace this term sent or ran! Not a good track record for sustainability and leadership at the Top end. Good luck attracting the needed leadership given the short lifespan of a CAO in the County. Any professional would demand a sizeable severance package prior to coming on board.

And nobody in Shire Hall is saying how much the taxpayer is paying in severance and benefit packages for the latest exodus (2025) of senior staff, the CAO included.

I think you will see people leaving the County. It has become unaffordable. Water bills are staggering!