County News

Clean

But financial sustainability remains a question mark

County auditors are like teachers reporting on a preschooler’s first day in class. A good start. No big messes. But a few things are giving them pause. Some issues for parents to watch out for.

It was a clean audit, reported KPMG’s Katie Mahon to the County’s audit committee last week.

“No issues to note,” said the auditor. It was good news for the committee members and Shire Hall, following a year of significant turmoil and senior leadership changes at the municipality.

But financial sustainability remains a question mark for the accounting firm. The County has big spending plans. It is not clear how Shire Hall intends to fund these plans. Or when.

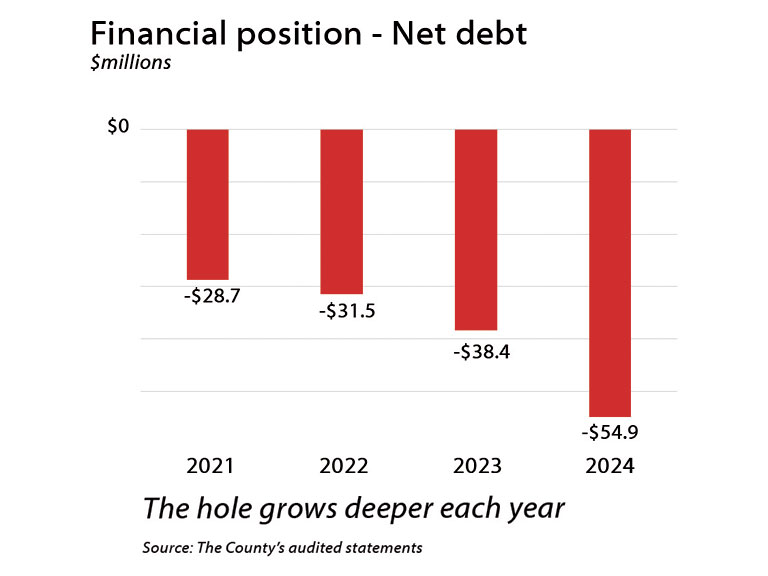

Mahon underlined the concerns by pointing to the County’s negative net worth (net debt). A year ago the County was $38 million underwater. Financial liabilities (money owed) was more than financial assets (money it had in 2023). The situation worsened last year. At the end of 2024 the hole had deepened to $54.9 million.

Mahon pointed to the County’s meagre reserve balance as another worry. One compounding the other. She highlighted the point by noting that $15 million of capital spending already in the works remains unfunded. It is unclear where the money will come from. Or when.

The auditor adds that on its own, net debt and low reserves may not necessarily ring alarm bells. It is because the municipality has room to take on more debt and a tax base (residents) who will fund it endlessly, for the property taxpayer is regarded as a warm body able and willing to pay more.

It’s not today that has the auditor on edge, but rather the road ahead.

“Future capital outlay is not part of this picture,” explained Ms. Mahon, adding that while she understands the County is considering big capital projects, equally big questions must be answered. When is the spending? And how is it to be funded?

Indeed, the County has big spending plans on the horizon—on roads, waterworks, infrastructure and facilities. KPMG’s Mahon repeated comments made last year, that she would be watching how the County’s plans unfolded and how they would be financed.

“How are these capital projects going to be financed?” asked Mahon.

Addressing questions from the committee on these points, the County’s finance director, Arryn McNichol, observed that much of the County’s net debt is “strategic in nature”. By this, he means that a large portion consists of investments the municipality has made, anticipating it will get paid back. In the case of the $100 million capital spending on a long-term care home, the province will eventually—over 25 years— pay back about $60 million. (The County tax base will bear the balance plus cost overruns, inflation and such.)

Similarly, the municipality is currently making investments in waterworks infrastructure in Wellington, anticipating that it will spur homebuilding, which will, in turn, generate development charge revenue to pay down this debt. However, when and how much this Rube Goldberg machine delivers the marble remains a live question.

There is significant uncertainty that such funding will happen, and the County’s debt picture will worsen further.

It is the stuff that keeps auditors awake at night. McNicholl noted that Council was meeting the following day (Thursday) to consider options to fund a widening infrastructure gap (defined as the County’s things—roads, bridges, buildings, etc.—which are crumbling faster than it can mend them).

Spoiler alert: A committee of council approved in that meeting to hike property taxes by 46 per cent —phased in over 10 years—to fund the capital side of its business.

Maybe it sticks. Maybe taxes spike to cover the municipality’s big spending plans. Maybe voters don’t revolt. Maybe they don’t elect a different council with different priorities. Maybe provincial and federal governments will return to the table with more infrastructure funding. Maybe new homes grow out of the fields around Wellington and Picton to fund development charges.

A lot of maybes. The County’s auditors are watching.

To hell with County taxpayers coughing up $25,000,000 for Cty Rd 49 if the Feds deliver their share. Should never have been downloaded upon us! Tyendinaga gets Hwy 49 for gas, smoke and weed shops providing no tax to the Province. Shut it down to local traffic only! Then see what happens. Tired of being used.

Could also just gravel the damned thing and then put up a sign – try the old “Use At Your Own Risk” and “Seasonal Use Only”. Just tell the Province we don’t have the money and we’ll shut it down if they don’t take it back.