County News

Juggling chainsaws and debt

Existing debt plus big capital plans equals big risk

Yes, we are leveraged,” confirmed Arryn McNichol, Director of Finance, describing the County’s debt to the Water and Wastewater Rates Community Meeting last week in response to committee chair Corey Engelsdorfer. “That’s plain to see.”

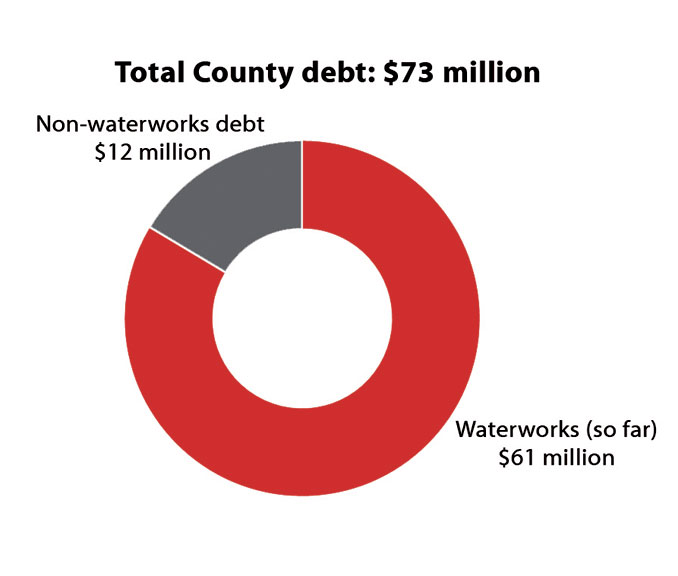

McNichol added that the $73 million in debt the municipality had accumulated by the end of 2024 could be described as ‘strategic in nature thus far.”

“Leveraged” in this context means that the municipality carries a meaningful amount of debt relative to its assets and cash flow. “Strategic debt” means that municipal officials believe that its debt was taken on to facilitate growth, and as such, may deliver a future benefit to County residents and water ratepayers.

“Moving forward, decreasing financial risk…while at the same time allowing for growth is the key,” said McNichol. “Moving forward will require prudent planning and an assessment of the financial risk we are willing to accept.”

“I am comfortable where we are today,” added McNichol.

The municipality, however, has several big capital projects on deck. Each represents a significant draw on the County’s borrowing capacity. These plans include $100 million, recently committed, for a new long-term care home in Picton (of which $60 million will be reimbursed by the province over 25 years). A $300 million waterworks expansion and 20-kilometre pipeline remain a live consideration. The rehabilitation of County Road 49 could also require the municipality to borrow perhaps as much as $25 million.

The scale of planned borrowing, combined with the County’s negative financial position (where its financial liabilities exceed its financial assets by $38 million), caught the attention of the County’s auditors last summer. They will comment next month.

McNichol is also currently finalizing a comprehensive, corporate-wide asset management plan (AMP) that will reveal the financial burden of 1,047 kilometres of roads, 63 bridges, 94 buildings, and 156 vehicles (see Column page 6).

“But how much debt is the County planning on taking on?” committee member Chris Ryerson wanted to know how much borrowing the finance director thought was feasible.

“If we incur a large amount of debt, our ARL (annual repayment limit) would be in jeopardy for sure,” answered McNichol. “We would definitely have to consider that.”

HOW MUCH IS TOO MUCH?

According to the Ministry of Municipal Affairs and Housing, at the end of 2024, the County had room to borrow between $60 million and $181 million more, depending on the term and interest rate. The municipality currently spends $4.3 million on servicing its debt ($2.0 million on interest and $2.3 million on principal). Currently, the County’s debt servicing capacity is capped at $14.5 million.

What about timing? When would the committee learn what was in store for ratepayers and taxpayers?

We are working through the technical aspects of the project currently,” McNichol explained. “We are also working on the growth numbers as well. We have received comments from the developers. I believe there have been three or four separate packages given to us, which we then passed on to Watson (a consultancy). Watson will take that into consideration. And then we will move forward with a development charges background study.”

“The asset management plan, the DC background study, the water wastewater rates study plan—there are a lot of moving parts, so we are trying to piece it all together,” said McNichol.

The committee heard a presentation about communications— how Shire Hall intended to introduce new rates, higher debt, and increased risk to ratepayers and residents.

Committee member Bob Cooke asked the communications team, Emily Cowan and Mark Kerr, if the communications strategy was having an impact.

“Have you reached out to the 6,000 water users to ask them what information they want to receive?” asked Cooke.

Councillor Janice Maynard chose to answer the question.

“The last rate study was well accepted,” said the Ameliasburgh councillor, suggesting the existing communications strategy was working. “We didn’t have a big backlash last time.”

Cook took a different tack. He cautioned the communications team against messages aimed at selling an outcome to ratepayers.

“Avoid promotion,” urged Cooke. “Give them information so they can make an informed judgement.”

Wellington on the Lake resident Dorothy Bothwell urged the committee to ensure the finance department produces a solid financial assessment and plan showing precisely how it intends to pay the debt already incurred. And that it should do so before spending hundreds of millions more on a new regional water system.

“Growth only pays for growth if growth actually happens,” said Bothwell. She pointed to the rate study conducted to inform water rates from 2022 to 2026 that predicted surging growth in residential homebuilding and a million square feet of commercial development.

“Reality check: It didn’t happen. Existing ratepayers are now expected to carry the bulk of debt,” said Bothwell.

““I am comfortable where we are today,” added McNichol.”

Is he a taxpayer in the County, I wonder?

If not, that would explain his comfort level.

——————————————————————————————

““The last rate study was well accepted,” said the Ameliasburgh councillor, suggesting the existing communications strategy was working. “We didn’t have a big backlash last time.””

Well accepted by who?

And because “We didn’t have a big backlash last time.”, this is evidence that “the existing communications strategy is working.”?